The Story of Twins - Direct plan vs Regular plan of Mutual Funds

Understanding the difference between Direct and Regular plans in Mutual Funds can save you a ton of money!

Mutual funds come in bewildering options. But before you pull your hair trying to answer which mutual fund to invest in, you must first closely understand the two avatars of every mutual fund- Direct plans and Regular plans.

Twins with a key difference

Every mutual fund has two variants- they come in pairs, just like twins. One variant is called Direct plan and the other variant is called Regular plan. They look the same, feel the same and smell the same as well. But these two variants have one key difference.

Direct plans charge a lower cost to investors as compared to Regular plans. For instance, the Direct plan of a mutual could be costing you 0.5 percent each year, whereas the Regular plan could be costing you 1.0 percent each year.

When you invest directly in a mutual fund, bypassing all intermediaries (like a bank, or an agent/distributor), your money gets invested in the Direct plan variant. If you are investing through an intermediary, your money gets invested in the Regular plan variant.

How to identify whether you have invested in Direct plans or Regular plans?

Identifying your mutual fund variant is fairly simple. All Direct mutual fund variants carry the word “Direct” in their nomenclature. If the mutual fund you have invested in does not have the word “Direct” in its name, you can safely assume it’s a Regular plan.

Why is there a difference in cost for the same mutual fund?

The answer is that mutual fund companies incur different costs when they onboard investors in Direct plans as compared to Regular plans.

In Regular plans, the mutual fund company must pay a commission to the intermediary through which the investor invested, and hence, Regular plans cost more.

When you invest directly, or through a SEBI Registered Investment Adviser (RIA), the mutual fund company incurs no commission cost, and can make available Direct plans of the same mutual fund at a lower cost.

Why does all this even matter?

Costs matter, and they matter a lot in investing. Let’s take an example of a popular mutual fund - Axis Bluechip Fund (Growth). Like any other mutual fund, it has two variants - the Axis Bluechip Fund (Growth) Direct Plan, and Axis Bluechip Fund (Growth) Regular Plan.

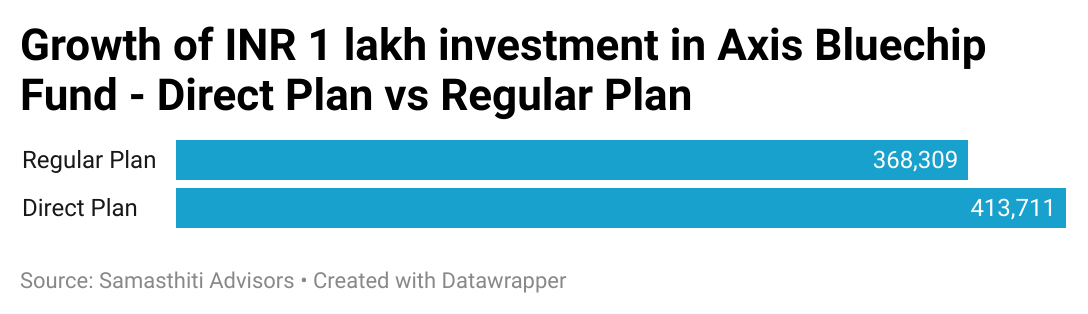

Let’s say you invested INR 1 lakh each in the Direct and Regular plan of Axis Bluechip Fund in 2013 (we are taking the year 2013 as Direct plans were introduced in that year). As of November 2022, your investment in the Direct plan would have increased to INR 4.14 lakhs whereas the investment in the Regular plan would have increased to only INR 3.68 lakhs. The accumulation in the Regular plan variant is lower by approximately INR 45,000- which is the amount that was paid to the intermediary through which you invested.

So, does this mean Regular plans are bad?

No, it does not necessarily mean that. But it is important to be aware of the following,

Regular plans of mutual funds cost you significantly more than Direct plans. It’s only when you are aware of the costs that you can evaluate if the service you receive from your intermediary is commensurate.

The commission paid by mutual fund companies to various intermediaries varies depending on which mutual fund they are selling. Some mutual funds pay a high commission while others do not, and this varying commission structure can lead you to investing in sub-par mutual funds. A mutual fund could have a terrific track record, but if it does not pay a high commission, chances are its Regular plan variant will be made invisible to you.

So, before thinking about which mutual fund to invest in, you need to decide whether you want to invest in Direct plans or Regular plans.

Our Take

At Samasthiti, we provide advice under SEBI’s Registered Investment Adviser (RIA) model, and hence, we recommend our clients to invest in Direct plans of mutual funds. This achieves two objectives. First, clients save on substantial commission charges during their investment journey. The advisory fee charged by us is a fraction of the commission cost that investors unwittingly pay in Regular plans. Second, clients are assured of receiving unbiased advice which has not been influenced by any commissions. So, it’s like eating your cake, and having it too!